MoneyWiz 2026

Budget and manage bills

Mac, iOS

Version 2025.50.2

macOS 14.0 or later

129.4 MB

22 languages

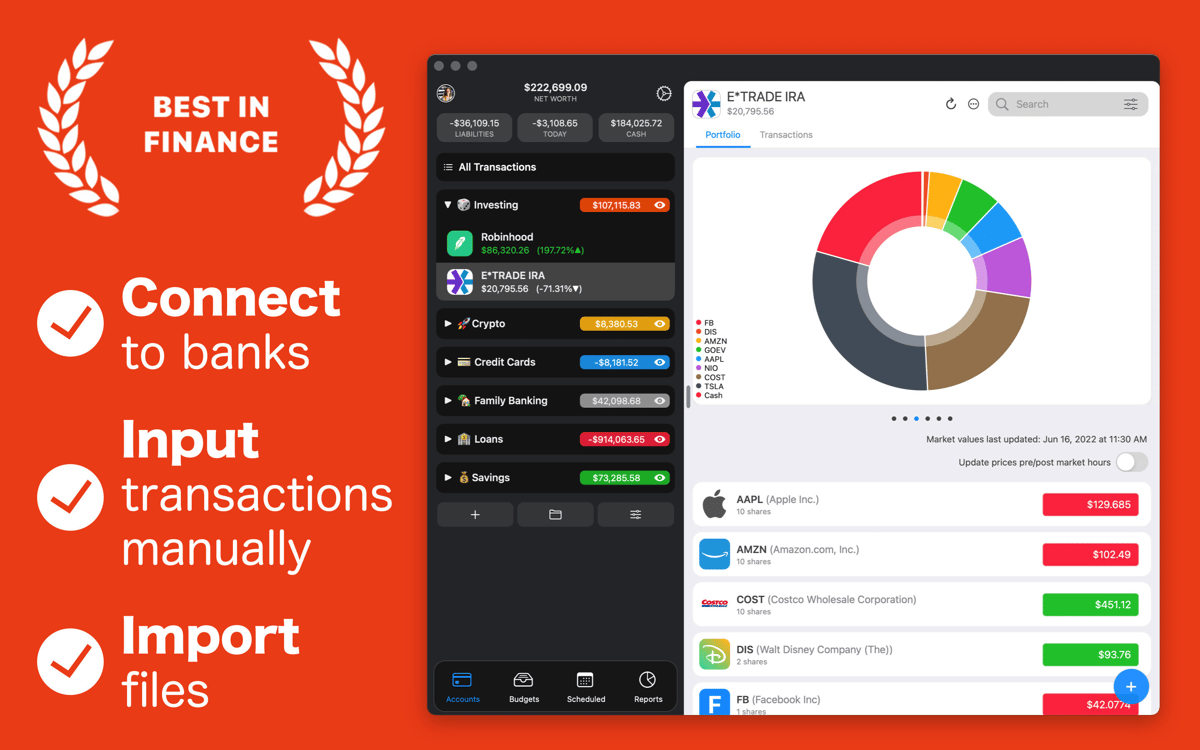

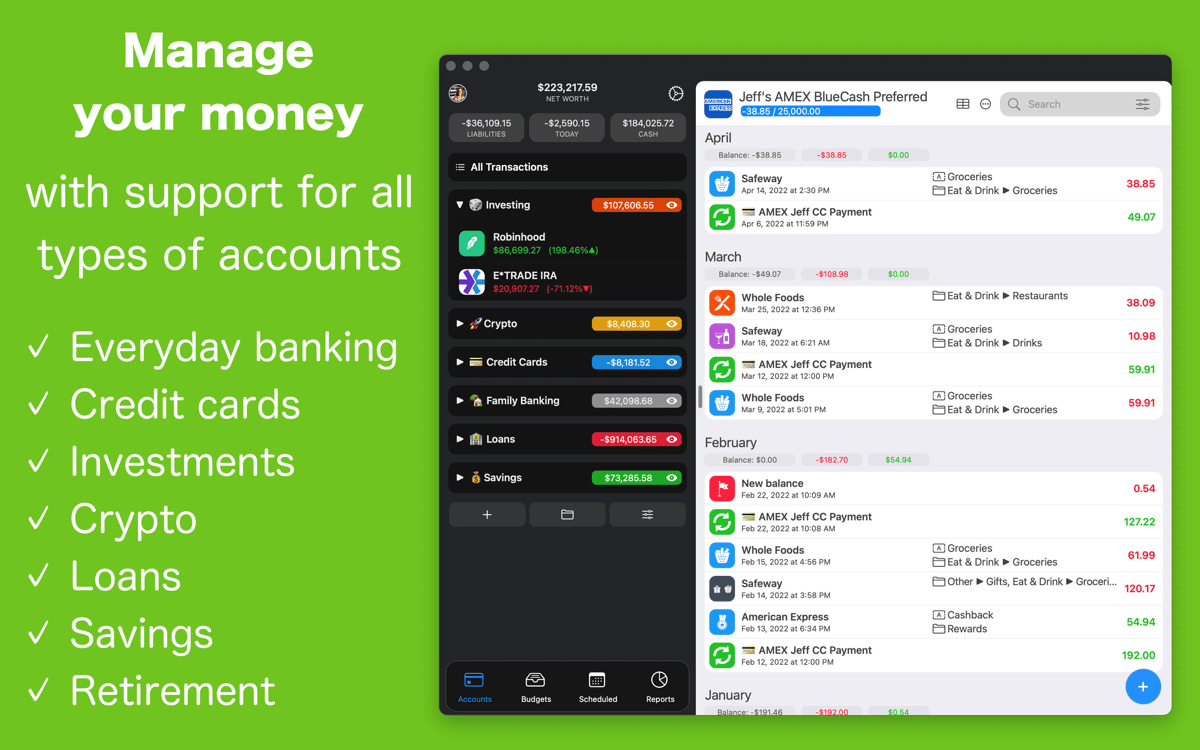

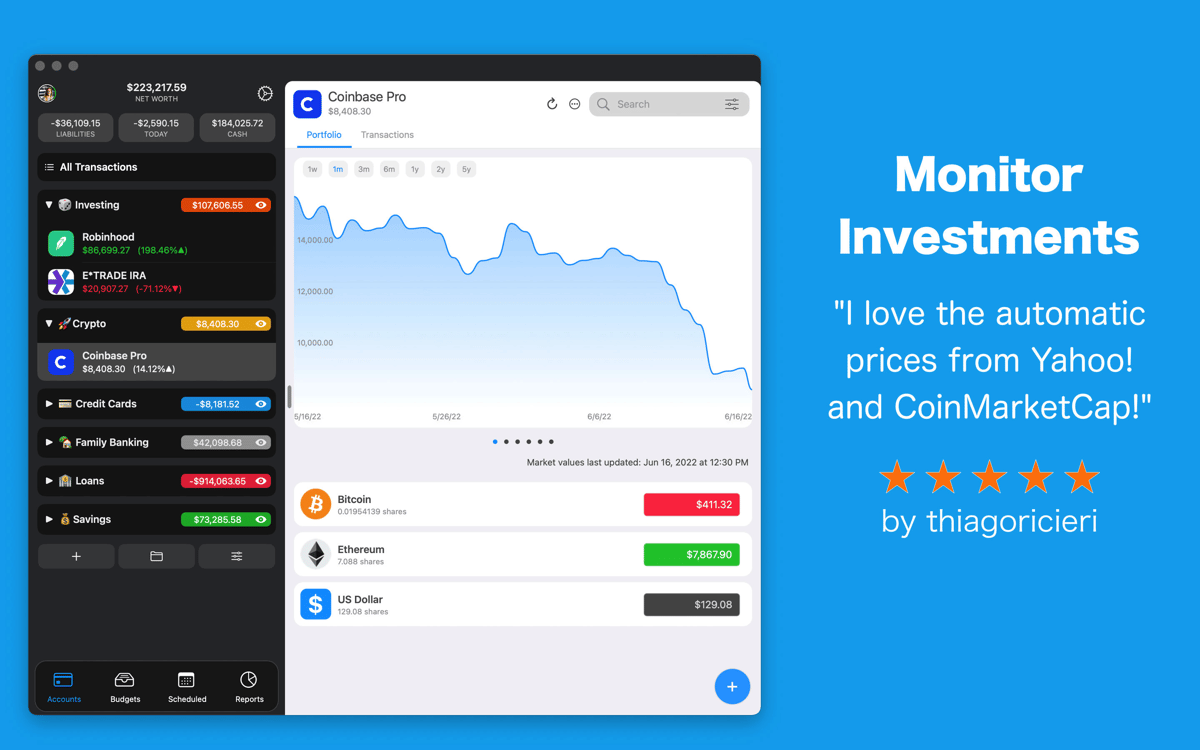

Make your personal money management easy with MoneyWiz 2026. This helper app makes it easy to track your spending and income, create budgets, and stay on top of your bills. The app allows you to take a deep dive into the way you manage your money, track your accounts and payments, and helps analyze your finances with handy reports.

Log spending and income

Create and manage budgets

Track past and upcoming bills

Analyze trends with 30+ report types

MoneyWiz 2026 features

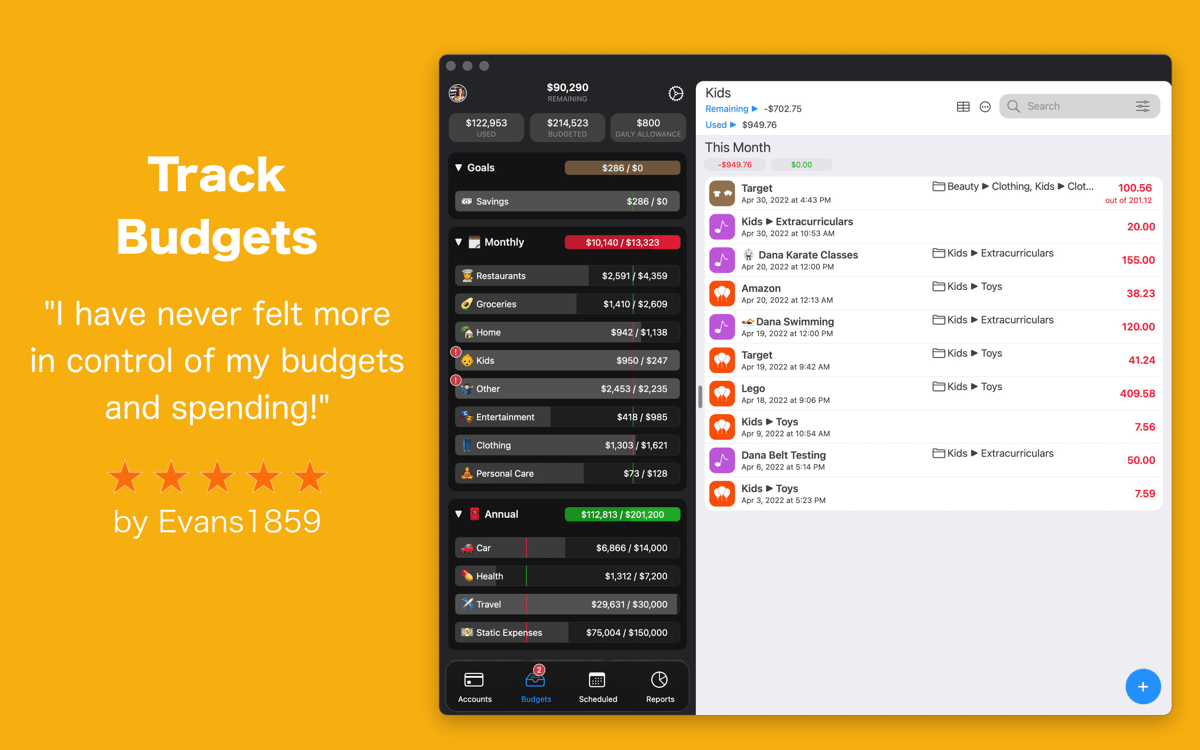

Manage your budget

Log your spending into MoneyWiz 2026 and track your net worth, balances, and transactions. Create income or expense-based budgets to help plan and manage your finances. Move money between budgets for easy adjustments, view budget progress, and more.

Track bills

Keep track of your recurring expenses and make forecasts of future spending with dedicated tools in MoneyWiz 2026. Browse your past bills or click on a date in the future to get an instant forecast.

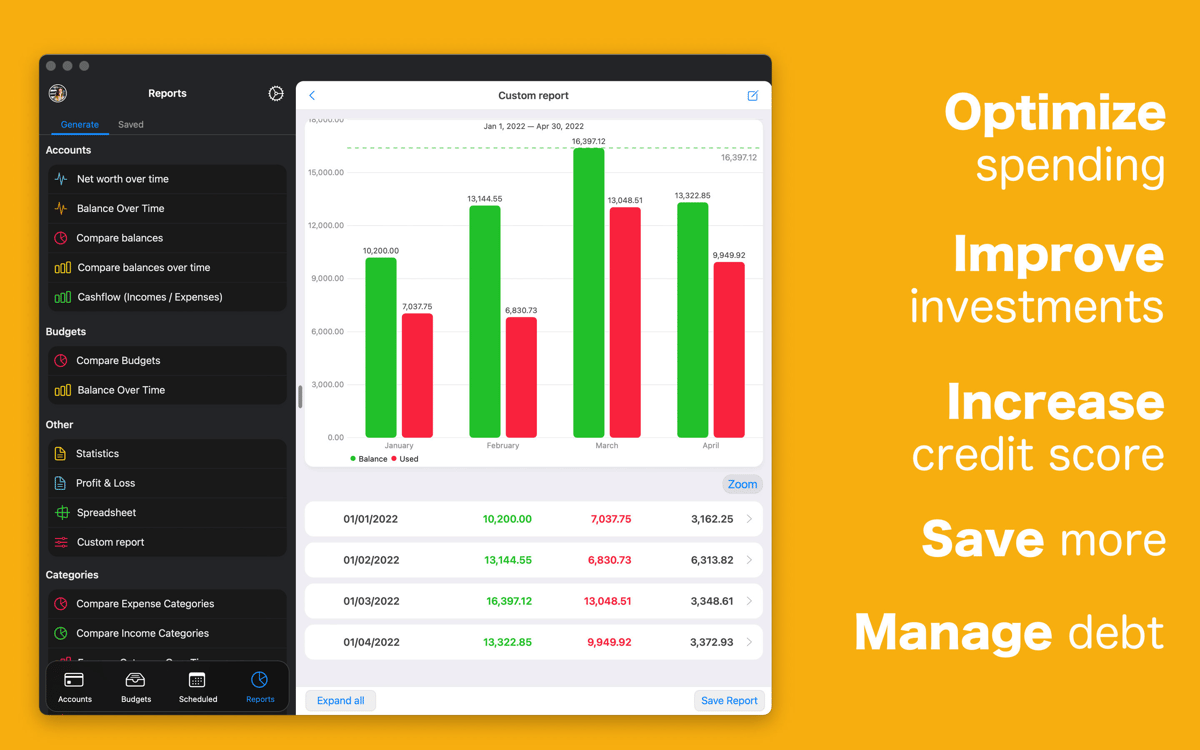

View spending reports

Tracking your income and spending for effective budgeting only truly works if you regularly take a look back at your results. MoneyWiz 2026 offers more than 30 types of reports for you to analyze your finances. Study them on your own or export as CSV or PDF to discuss with your financial advisor, accountant, or partner.

Import data

If you’ve been tracking your finances with other tools or want to add information from your banking app, import the data into MoneyWiz 2026 from these formats: CSV, QIF, OFX, QFX, MT940. The app will skip duplicates and try to automatically link categories and payees.

Customize your input

Customize MoneyWiz 2026 to your needs to skip fields you don’t want to input data in and view just the essentials of your transactions. Use the app’s extensive customization options to get the best money tracking experience for your personal finance needs!

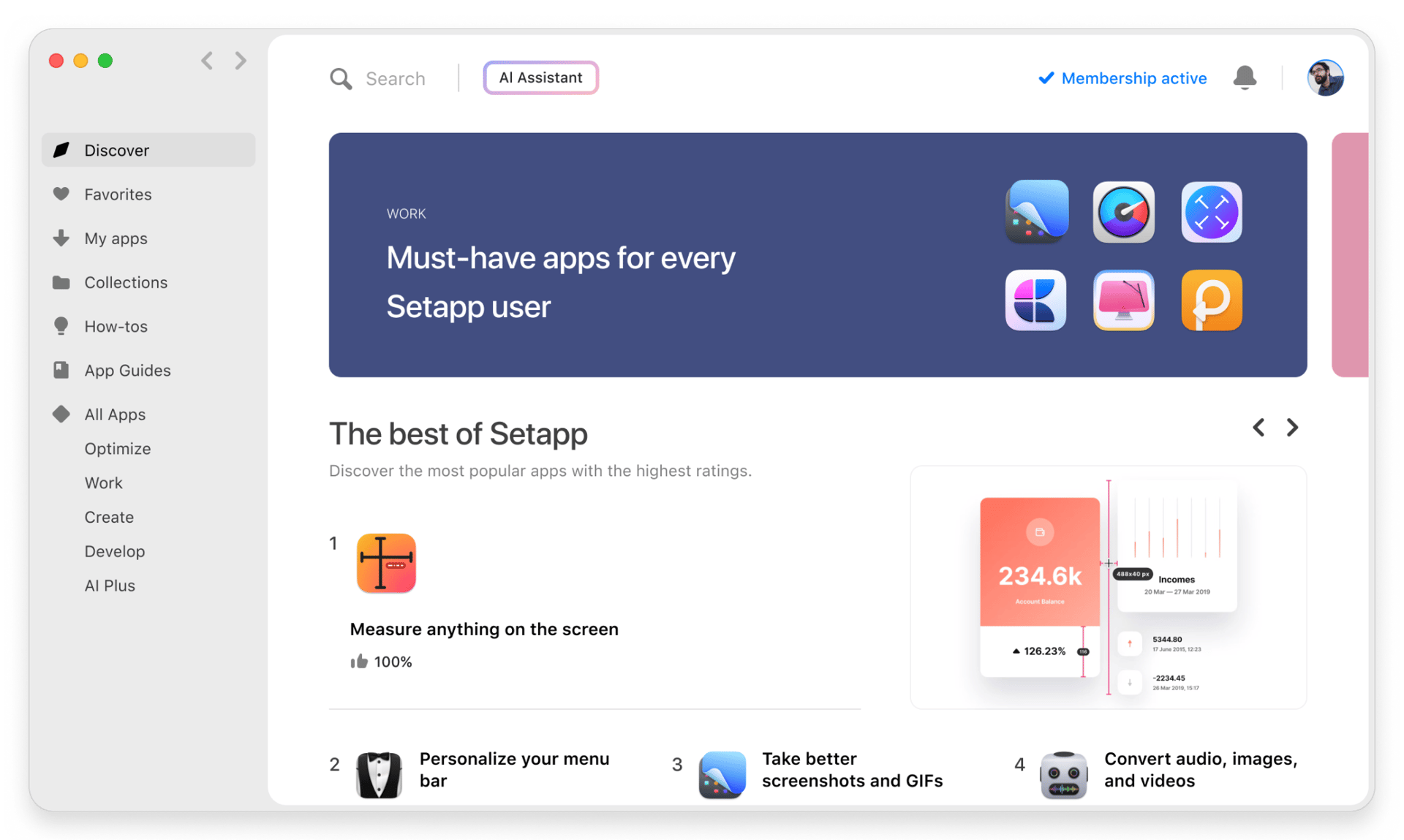

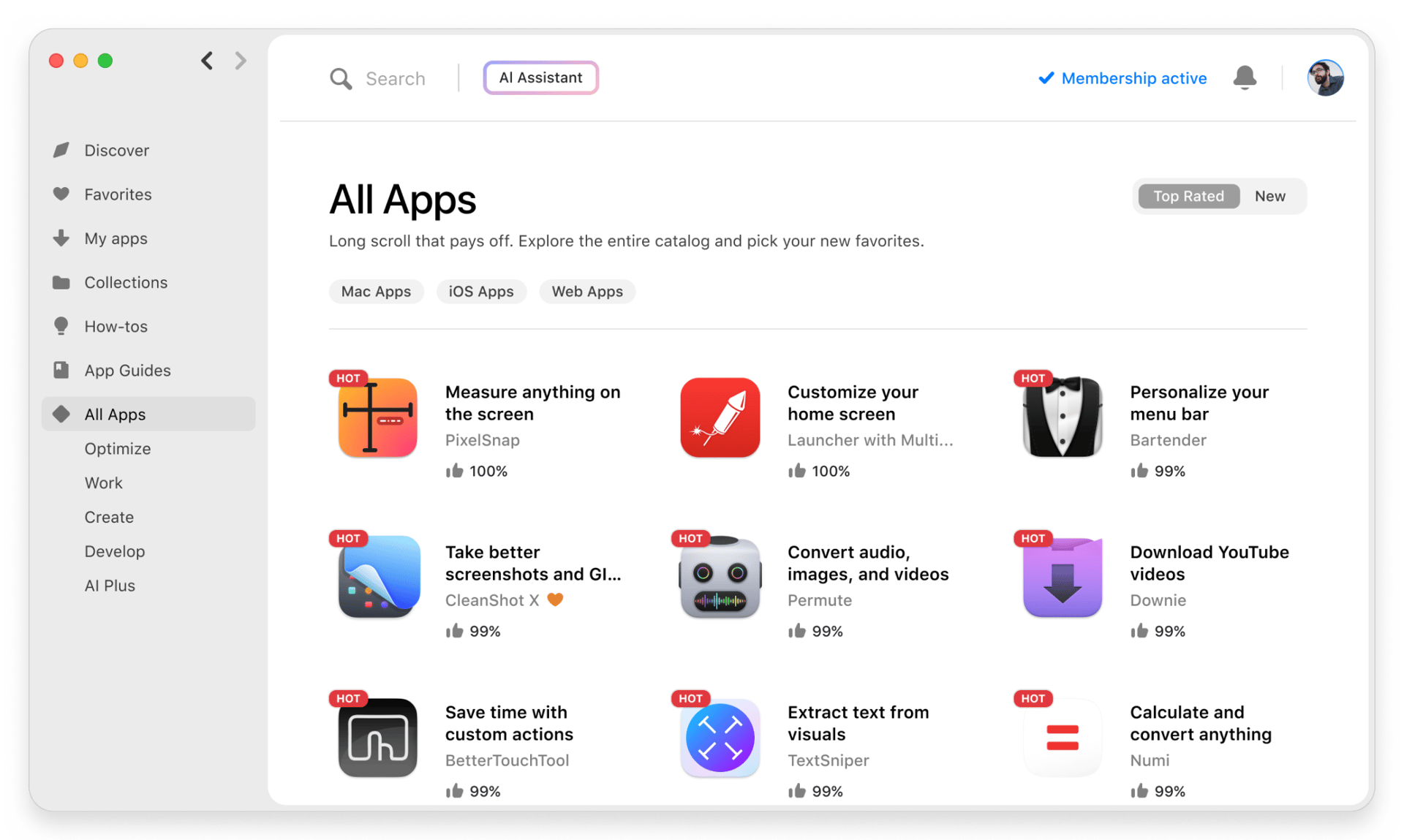

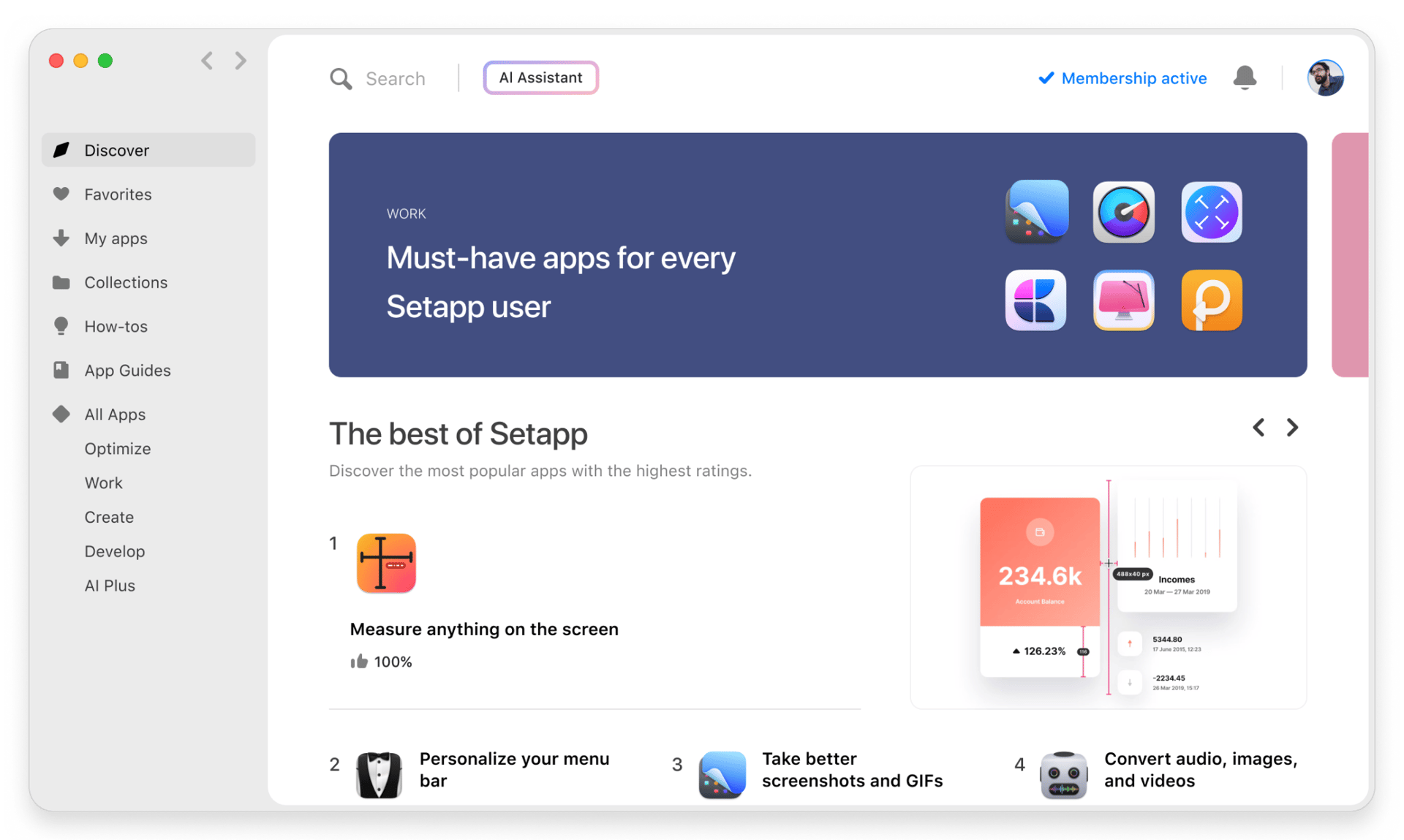

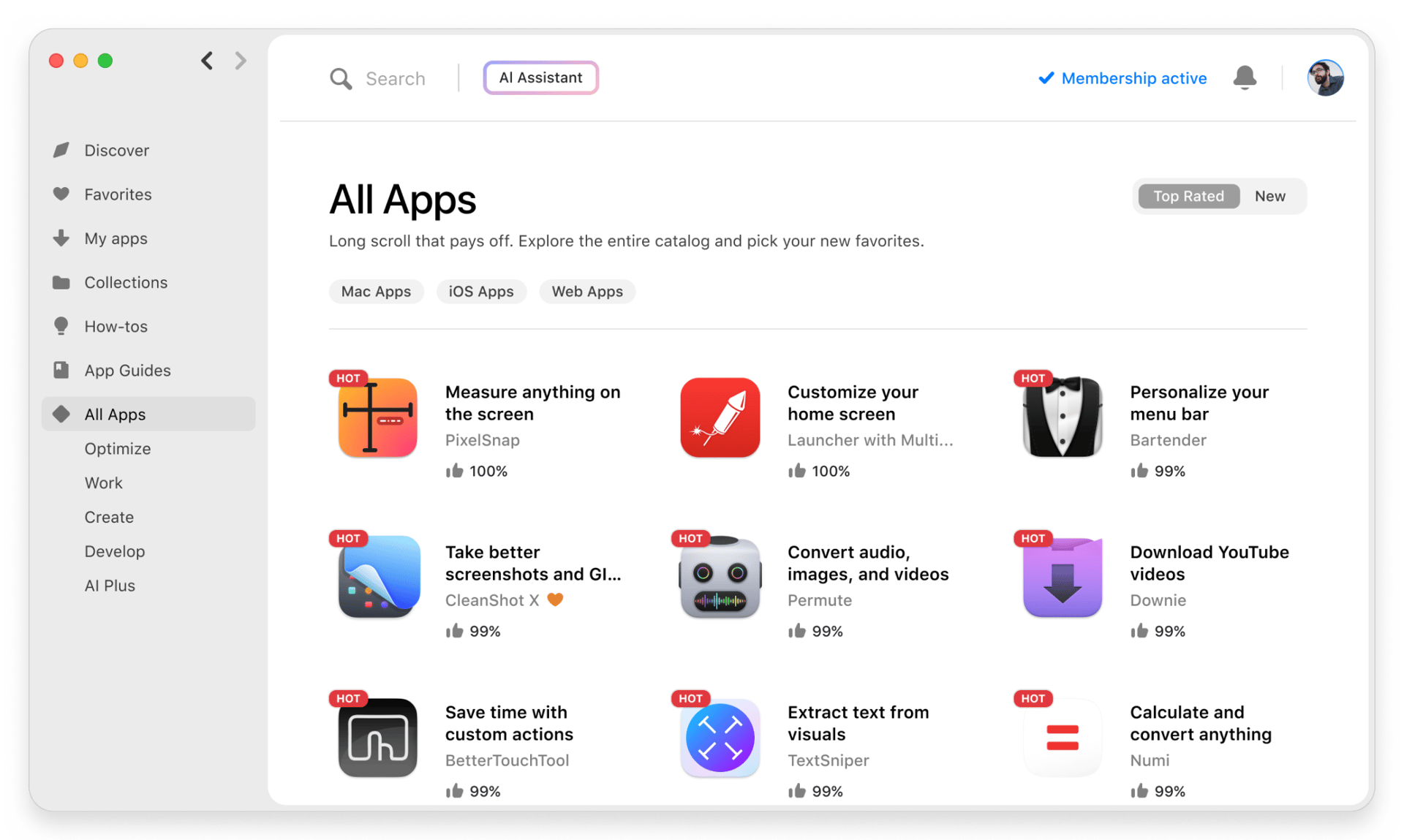

Get hundreds of apps with Membership

Become Setapp member and use hundreds of stellar apps with one subscription.

Try 7 days free, then pay one simple fee.

1

Install Setapp on your Mac

Explore apps for Mac, iOS, and web. Find easy ways to solve daily tasks.

2

Get the app you came for

That one shiny app is waiting inside Setapp. Install with a click.

MoneyWiz 2026

3

Save money and energy

The Membership helps you solve daily tasks, without overpaying for software.

1

Install Setapp on your Mac

Explore apps for Mac, iOS, and web. Find easy ways to solve daily tasks.

2

Get the app you came for

That one shiny app is waiting inside Setapp. Install with a click.

MoneyWiz 2026

3

Save money and energy

The Membership helps you solve daily tasks, without overpaying for software.

Home to the top apps

From planning and routine tasks to creative pursuits and coding, tackle tasks with apps on Setapp.

MoneyWiz 2026

Budget and manage bills