6 BEST receipt scanner apps for Mac to simplify expense tracking in 2026

Check out my top scanner app picks. All available on Setapp with a seven-day free trial:

It took me years to find the best way to budget, file taxes, and invest, and I certainly couldn’t have done it without paperless tools.

But despite my loyalty to digital solutions, my biggest struggle was tracking my expenses, considering not every physical store offers email receipts. A serious gap in my financial tracking left me feeling unconfident about my spending habits, so I started searching for solutions — some sort of digital receipt organizer that could solve my record-keeping woes.

In a similar boat? I’m going to show you how you can keep track of receipts in a modern way and give you a rundown of the best apps to get you started.

What is the best app for tracking receipts?

When it comes to receipts, having the right receipt tracking app can really help you stay on top of your expenses. Check out the comparison below to see what makes each app unique and figure out which one works best for you:

| Let’s compare! | Expenses | GreenBooks | Invoice Rex | MoneyWiz 2025 | Receipts | Chronicle |

| Compatibility | macOS, iOS | macOS, iOS | macOS, iOS | macOS, iOS | macOS | macOS, iOS |

| Multiple currency support | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| OCR-based | ✕ | ✕ | ✕ | ✕ | ✓ | ✕ |

| Simple import | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Search and filtering | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Saving to cloud | ✓ | ✓ | ✓ | ✓ | ✕ | ✓ |

| Set up reminders | ✓ | ✓ | ✕ | ✓ | ✕ | ✓ |

You may also like the article about the best budgeting apps on a Mac.

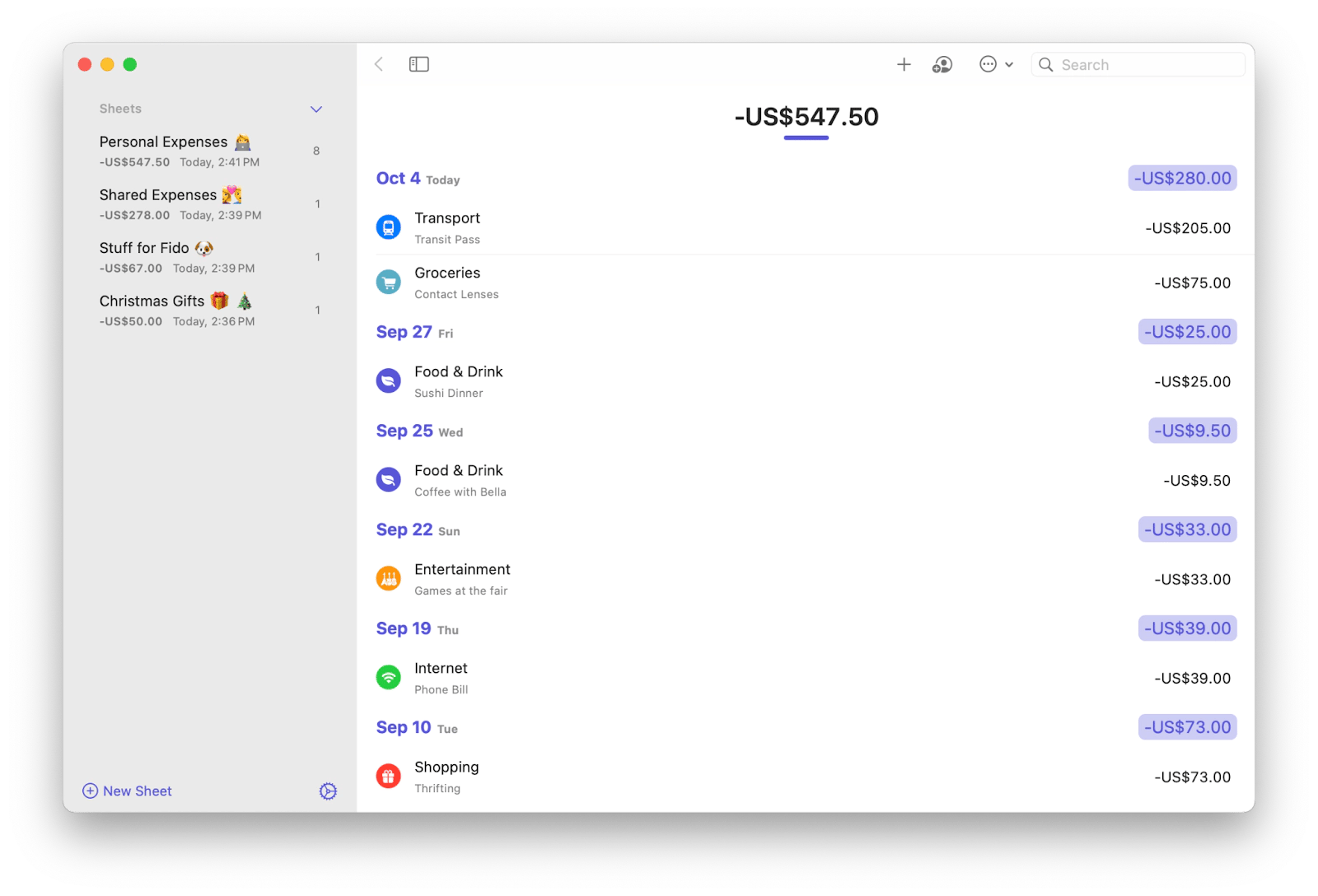

Expenses: Most intuitive for budgeting

If you’re looking for an easy-to-use expense tracker complete with icons, categories, and colors, Expenses is a practical app that caters to those needs. You can create a variety of different sheets specifically for trips, events, and daily expenses to keep things organized, switching currencies when needed. Want to know where your money is really going? The app will give you a full picture of trends and stats over time.

Pros: Intuitive interface, easy importing and exporting, no learning curve

Cons: May be overly simplistic for some

Privacy & security: Data backup features for extra protection

Best for: Simple expense categorization

Pricing:

Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

Free trial: Yes, 7 days

GreenBooks: Minimalist personal finance app

GreenBooks is the ideal no-frills app if you want a spending tracker to manage your money based on your accounts. Either import or manually input transactions made using each account, and you’ll get a full breakdown of your spending habits and trends. For subscriptions and scheduled transactions, you can set recurring reminders so you’ll never forget to pay up.

To me, this app feels incredibly minimalistic and straightforward, which is just what I need. I completely agree with the Setapp user who described it as, “Simple and elegant app, which is precisely what I was looking for. However, if you're looking for more advanced functionality and integrations, look at MoneyWiz.” MoneyWiz is also on my list. So keep reading.

Pros: Minimalist features and interface, interlinks with bank account information

Cons: No easy receipt capture, requires manual input

Privacy & security: iCloud's built-in encryption for syncing and storing data securely across devices

Best for: Visual financial habit tracking

Pricing: Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

"I’m a very structured person, and tracking my finances helps me stay grounded. GreenBooks makes that process effortless. I love how I can see all my accounts, analyze spending trends, and manage budgets in one clean interface. It’s the only finance app I actually enjoy using", shares Oleksandra Melnyk, Product Marketing Manager.

Free trial: Yes, 7 days

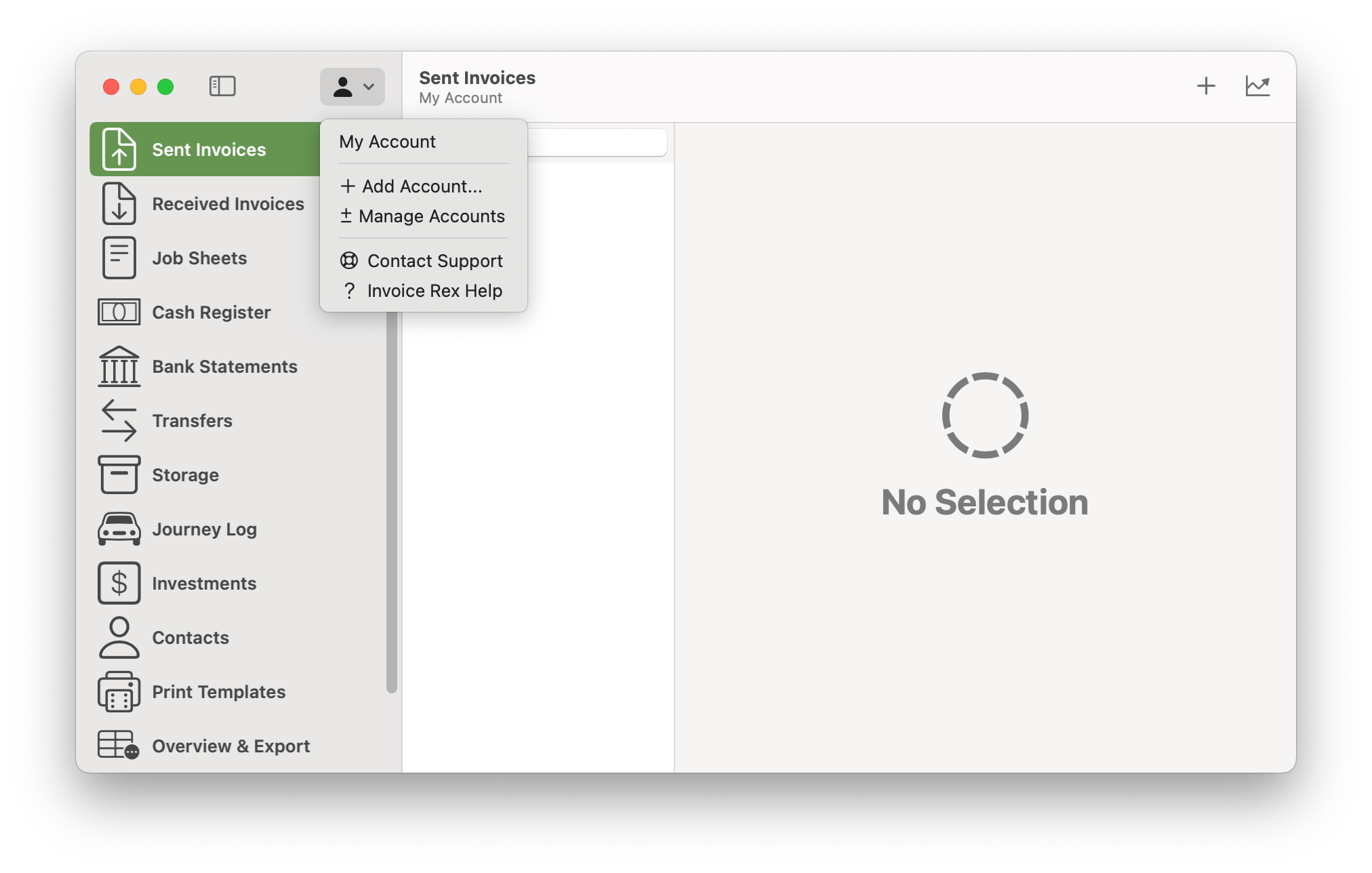

Invoice Rex: Joint invoicing-accounting platform

If you constantly deal with lots of invoices and statements, Invoice Rex is an ideal tool. The platform connects invoicing and accounting processes in one place, letting you manage your finances a lot more holistically. It’s marketed as an invoicing utility where you can build custom invoicing templates, handle bank statements, and sync across devices.

Pros: Editable invoice templates, simplified accounting process

Cons: Users unfamiliar with the app’s interface or functionality may need some time to adjust and learn its features.

Privacy & security: Secure local storage for sensitive information

Best for: Advanced invoice management

Pricing: Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

Free trial: Yes, 7 days

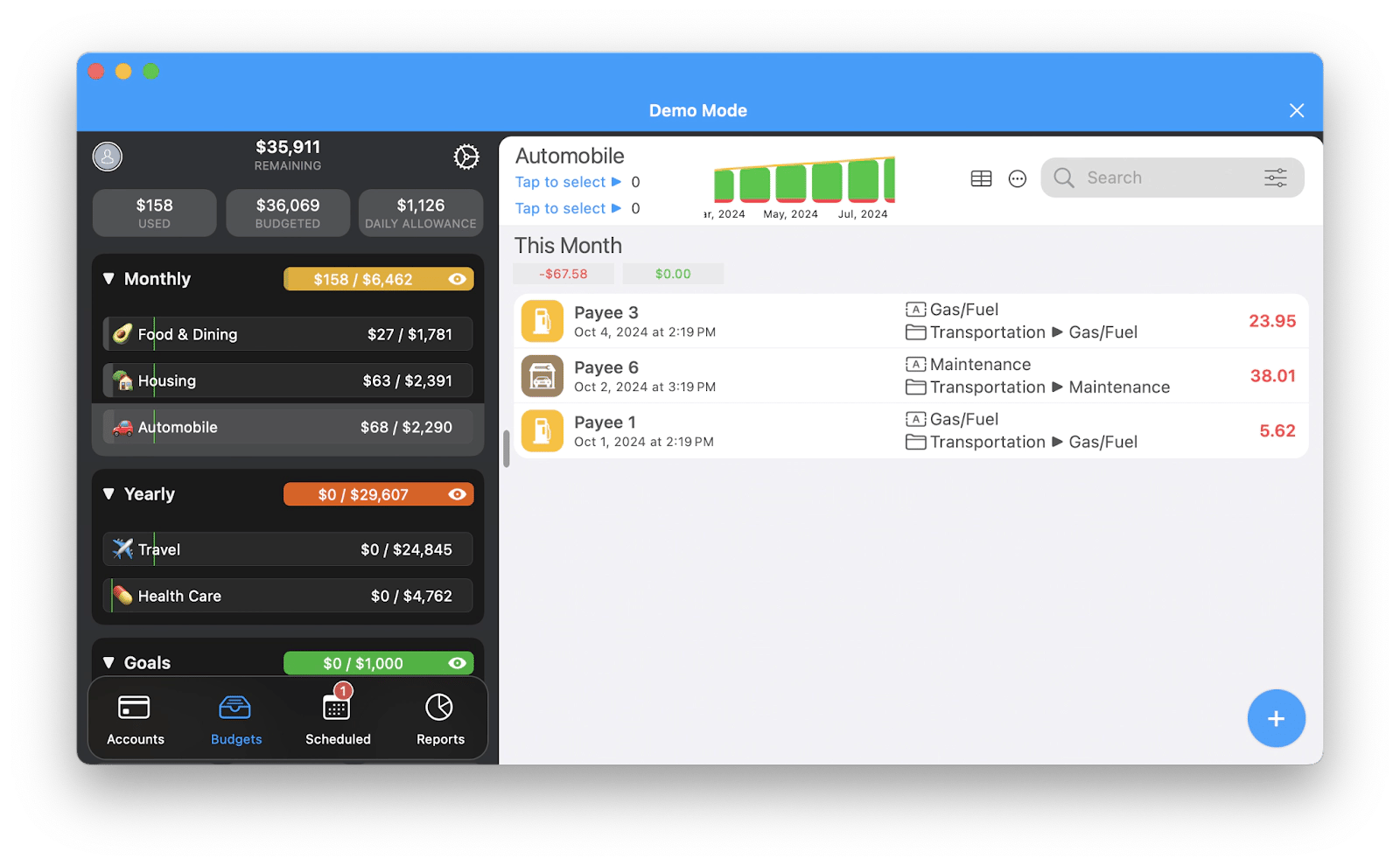

MoneyWiz 2026: Best customizable budgeting app

MoneyWiz 2026 is a complete money management platform and one of the best personal finance apps for Mac, where you can track bills, forecast your future spending, and use it as an overall budget tracker. There’s a tab dedicated to your bank accounts and investments, one for budgets and goals and another for scheduled income and expenses. It’ll give you a real-time view of what’s coming in and going out, so you’ll never be caught off guard.

Personally, I love MoneyWiz because it's highly visual — the graphs and stats make it easy to see where my money is going. I enjoy creating custom reports every month to track my progress. Honestly, this app has helped me improve my credit score and save 15% more, making a significant difference in my financial health.

Pros: Complete dashboard for a view of your accounts and budgets with detailed expense tracking reports

Cons: Can be considered overly granular

Privacy & security: Data encryption for local storage

Best for: Automatic bank synchronization

Pricing: Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

Free trial: Yes, 7 days.

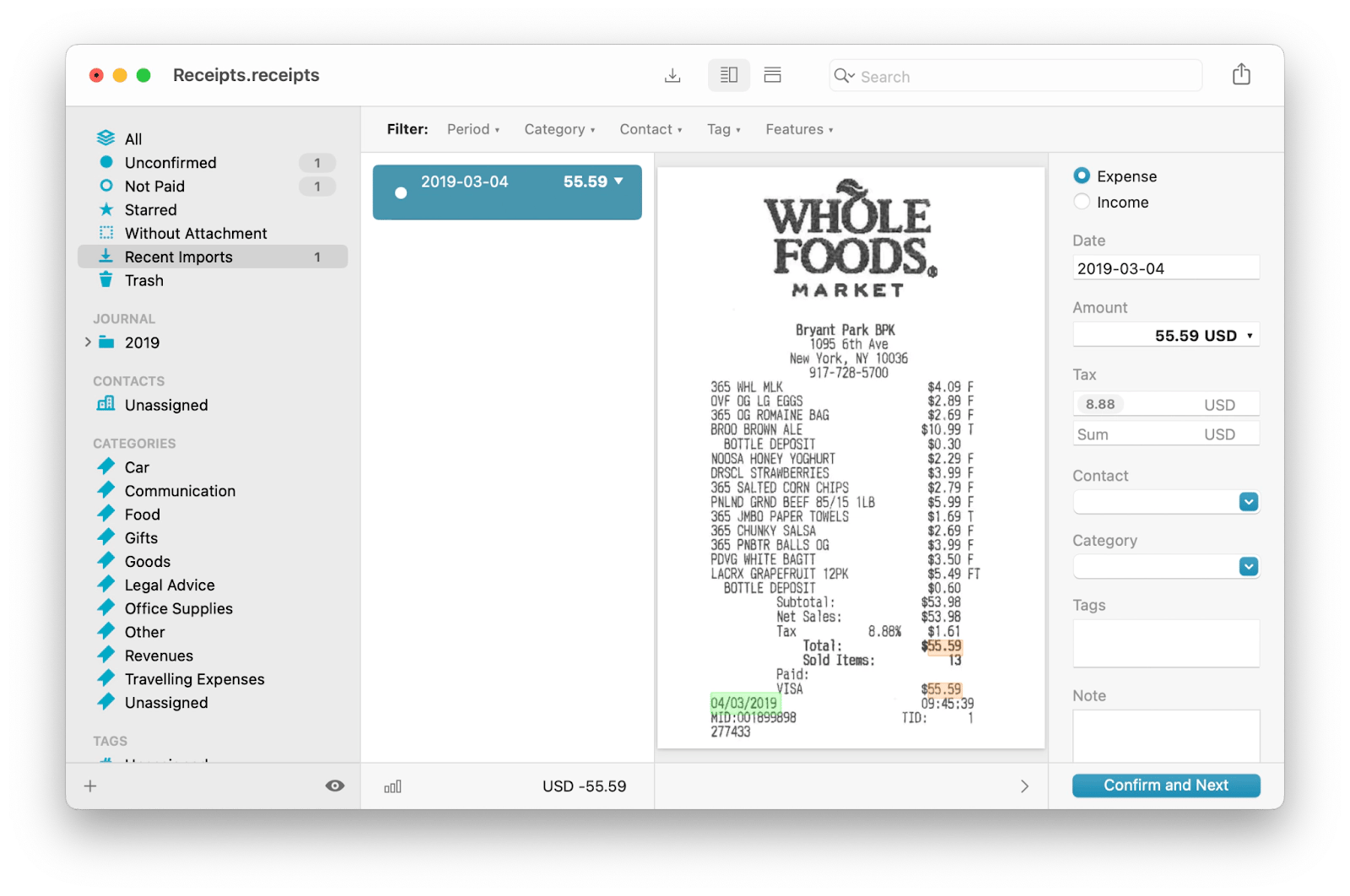

Receipts: For OCR-based scanning

No matter the format, Receipts can turn any document into an easy-to-read PDF and automatically extract important data like the date, numerical totals, and tax amounts. It’s a receipt manager app that can essentially read your receipts for you and break them down, then organize each one by your preferred criteria. It’s like a smart assistant that’ll compile invoices and receipts and make sense of them in a digital format.

A satisfied Setapp user shares their experience about Receipts: “I just wanted to quickly check this app as I already collect income/expense info in Notion automatically. But it worked so good, that I got "Addicted" and ended up importing and processing 10 years of Business receipts. While not perfect, the OCR does a good job, and the system works. Perfect little cashflow monitoring app.”

Pros: Best scanner app for powerful OCR capabilities, extensive integrations with invoice creation and direct payments, end-to-end customization

Cons: Dry interface, no compatibility with iOS

Privacy & security: Data encryption and secure cloud storage

Best for: OCR receipt scanning and categorization

Pricing: Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

Free trial: Yes, 7 days

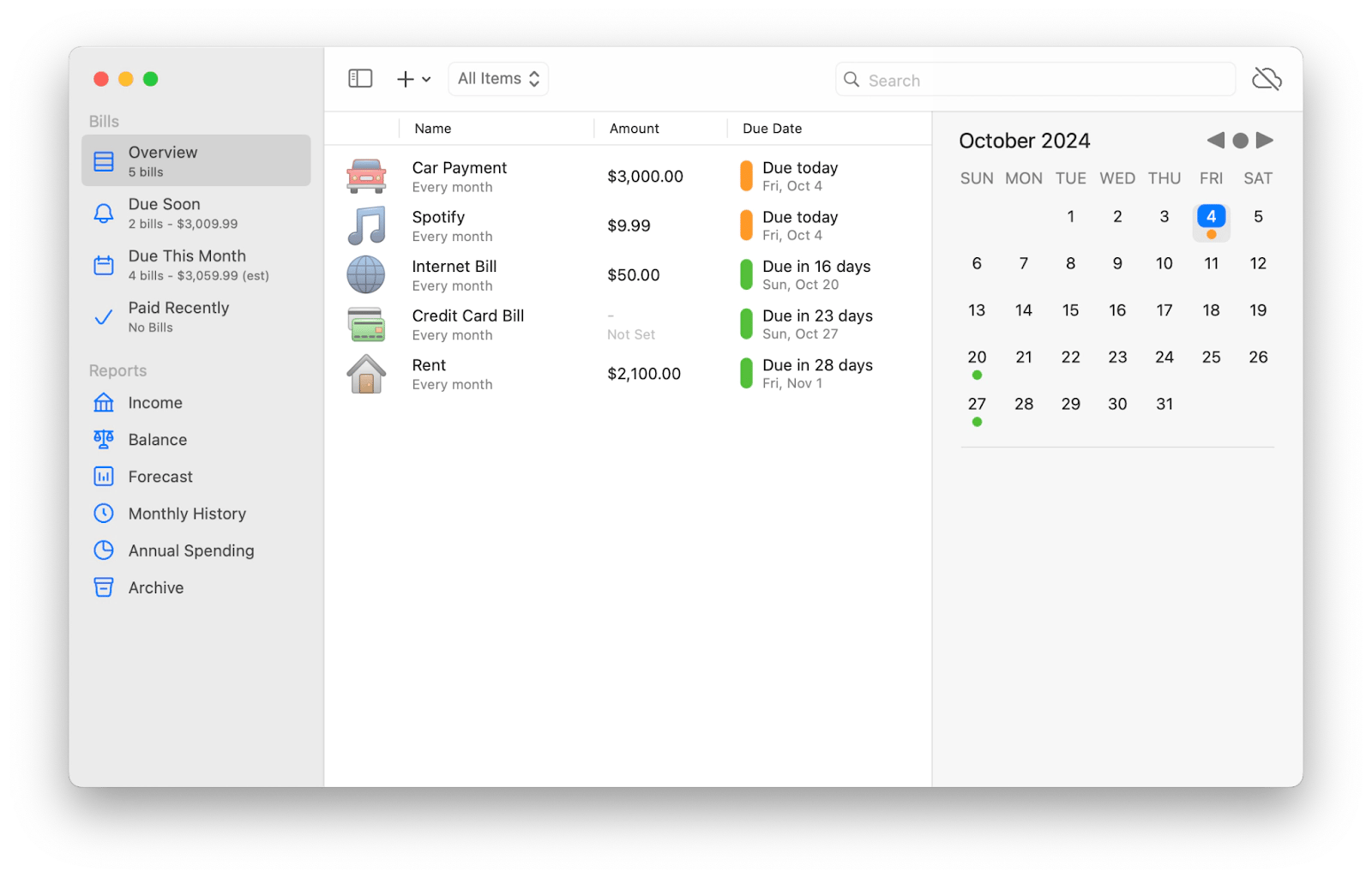

Chronicle: Expense tracker and payment reminder app

Is your main goal to track your expenses and pay bills on time? Try Chronicle, a full-fledged receipt saver and expense-tracking software with a clear interface. View your entire payment history in a quick overview, and attach receipts and invoices to every logged transaction for proof-of-payment purposes. The menu bar interface does wonders to remind you of payments, and the integrated Pay Now button makes it easy to pay bills on the spot.

“It's been great for me as a self-employed individual. After having to use 2 programs to do what this one does in 1, I have to say I am very impressed and happy I stumbled upon it! Highly recommended for anyone wanting to be organized,” says a satisfied Setapp user about Chronicle.

Pros: Menu bar feature, stringent payment reminders, bill management, built-in browser to make payments,

Cons: Lots of detailed bill reminder options, which can be considered overwhelming

Privacy & security: Password protection of sensitive information on local storage

Best for: Recurring bill tracking and reminders

Pricing: Available on Setapp, a platform with 250+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay a flat monthly fee.

Free trial: Yes, 7 days

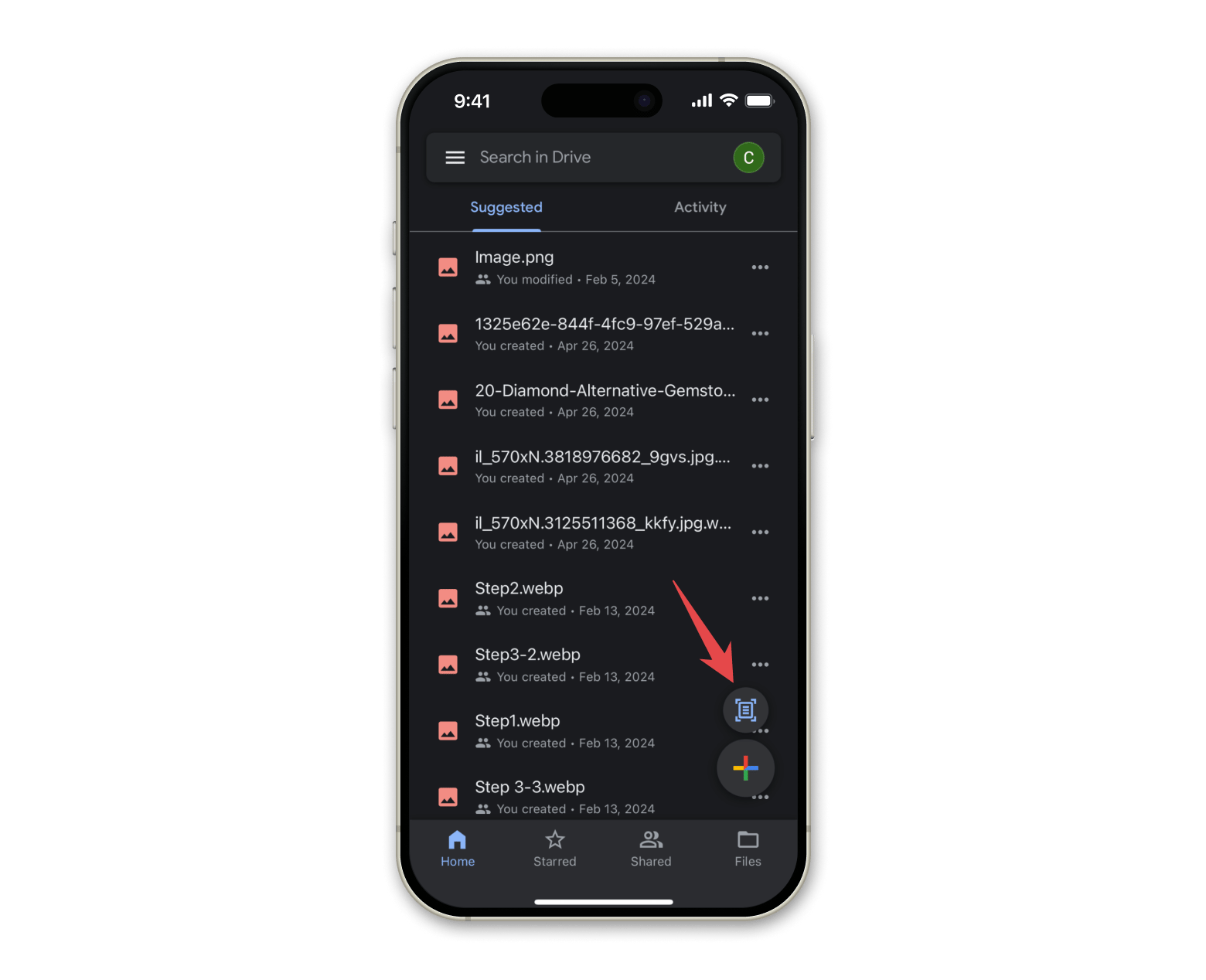

How to scan receipts at no cost

A receipt scanner doesn’t have to end up being a hefty cost on its own — you can practically start incorporating this money management process for free. For example, Google Drive has a built-in scanner that’s especially useful to scan receipts and other documents. All you have to do is on your iPhone:

- Download the Google Drive app.

- Log into your account.

- Tap the scan button on the Home page.

- Point your camera at your receipt or document.

While this method and others are free, there are features that a dedicated tracking receipts app will have that can upgrade your financial management even further. It can be a good idea to test free alternatives at first, but then consider finding the best receipt scanner app for your needs.